Music streaming: Ad likely primary monetization tool

Growth drivers in place: Indian music streaming market has grown significantly, especially in the last 3-4 years with our checks suggesting an increase in MAUs from 30- 35mn in 2016 to c. 200mn+ currently. Unlike China music streaming where one player (Tencent Music) dominates the market with 80%+ market share, we find Indian music market fragmented with JioSaavn, Gaana and Airtel Wynk all having 100mn+ installs/ MAUs. Competition off-late has been increasing with players like Spotify/Apple Music entering the market. Going forward regional focus and personalization would likely be the key focus areas the players could have to differentiate themselves.

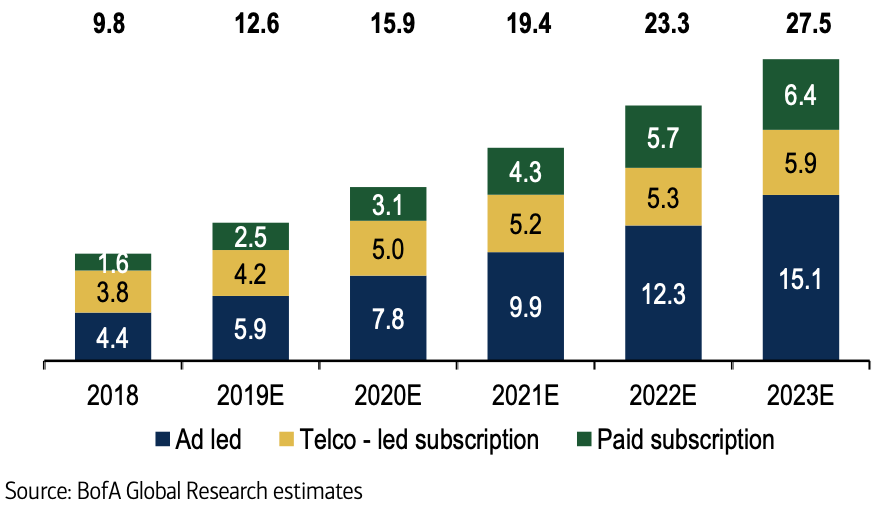

Ad likely the key way to monetize: Given Indian consumers’ low propensity to pay for music services and widespread prevalence of consuming pirated content (76% of internet users listened to pirated music), we believe that growth in audio streaming would be through bundling by telcos. We expect the Indian music streaming market to be largely an ad-led model. We expect subscription market to be relatively smaller and focused more on the high-end market (primarily addressed by Spotify/Apple Music). Similar to content, the telco led partnership is evolving into an India specific manner with telcos like Bharti/Jio having controlling stake in streaming apps Wynk/JioSaavn respectively. We expect the music streaming industry size to grow at 23% CAGR from 2018-23E with mix between ad/telco and paid subscription to be 75%/20%/5% respectively in 2023E.

The 3 key domestic apps are doing well: 1) Gaana’s features include: voice search feature, where 25%+ of its users this, Incremental focus on regional languages to increase subs base and simplified song-based layout; 2) With a parent-co like Jio, JioSaavn is in a sweet-spot as overtime it could have access to c. 500 mn Jio users. It also has access to high end advertisers (RIL partner brands like Diesel, Salvatore Ferragamo) and could leverage media tie-ups like MTV, Vh1, and Network18. Similarly Airtel’s Wynk would also be able to benefit.

..and have expanded into the video format: Post the TikTok ban, besides several new homegrown apps entering in the space, we have also seen the entry of Gaana ‘HotShots’ as a short-video section within the app. JioSaavn announced a strategic partnership with Triller (a music video platform) and has embedded within the JioSaavn music app. The integration provides JioSaavn users access to exclusive video content from Triller within JioSaavn app. Users can also record their own videos to have them appear on the app.